Page Contents

Chronic illnesses are conditions that last for a long period (usually a year and more), requiring long-term medications and care. Some limit the Activities of Daily Living (ADL) and affect your Quality of Life (QoL). Common examples are diabetes, cancer, heart diseases, kidney diseases, stroke, mental health conditions, etc. Many of these chronic illnesses are attributed to lifestyle and diet, which you can manage or even reverse with proper mitigations.

That being said, it is crucially important to have enough savings and insurance protection to secure your finances. Having insurance is like having a fire extinguisher. You wouldn’t want to use it unnecessarily, but in time of fire, you know it is available.

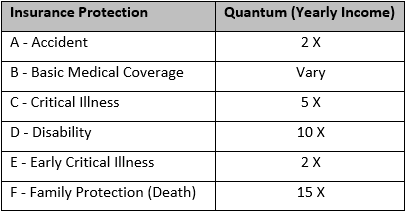

As a rule of thumb, you should have general health insurance policies to cover the ‘A to F’ aspects of medical needs (Figure 1).

A – Accident

Accidents can range from a minor injury to disability or death. Accident plan usually covers all phases of the accident, which could include evacuation, hospitalisation, treatment, rehabilitation, and recovery. The rationale of having coverage of 2 times yearly income is to ensure that you can continue paying your living expenses for 2 years while you are undergoing recovery caused by accidents. Of course, in the event of death, the compensation is never enough, but you should have family protection insurance to cover that possibility.

B – Basic Medical Coverage

There are two types of medical coverages:-

- Common illnesses can usually be treated by family doctors or general practitioners at local medical centres and polyclinics. These are the episodic acute conditions that can be treated without long-term follow-up, such as cold, cough, flu, fever, ear infection, skin infection and rashes, urinary tract infection, headache, diarrhoea, and food poisoning.

- Treatments for major illnesses that require hospitalisation or long-term follow-up include surgery, implants, chemotherapy, radiotherapy, immunotherapy, dialysis, and psychiatric treatment.

C – Critical Illness

Critical illness insurance is essential as healthcare cost is on the rise worldwide. It covers various critical illnesses including major cancers, heart attack, stroke, kidney failure, liver failure, surgery, transplant, etc.

Most insurance plans pay out a lump sum because of high medical costs, and some also protect against recurring and relapse conditions. Critical illnesses take longer to treat and recover; therefore, the amount of coverage uses 5 years of income as a basis to estimate.

D – Disability

In the event of disability caused by an accident, acute or chronic medical conditions, your personal income will be affected because of inability to work. If you are the sole breadwinner, how are you going to support your family for a long period? This is when the disability insurance kicks in; its purpose is to compensate you a lump sum of money or regular payments as income replacement for the period that you cannot work. The cost of living can increase dramatically when you are disabled. For those who cannot perform basic Activities of Daily Living (ADL), you may even need to hire a caregiver or nursing aid. Therefore, the coverage for disability insurance is recommended at 10 times your yearly income.

E – Early Critical Illness

Early critical illness is specially catered for diseases that are diagnosed at an early stage. This is especially helpful as the earlier you receive treatment, the chance of recovery is also higher. As such, early intervention is critical and you would surely need a significant amount to cover the medical bills and to make up for lost income during recovery. For this, the coverage is therefore recommended at 2 times of your yearly income.

F – Family Legacy

Death is not simply the end when you pass on, you leave behind the bills for the funeral, legal fees, huge medical bill and other debts to the family. If you have a life insurance, you could have left some legacy for your family after offsetting the bills; but if you are not protected, you only leave them with a tremendous burden. The coverage of 15 times yearly income will not last forever, but it is a token of your love for your family.

In conclusion, get yourself protected by signing up for appropriate insurance plans within your budget; the proposed coverage amount is only served as a guideline for not being overly insured.

Disclaimer: This blog post is not sponsored by any insurance company and does not represent or advertise for any of them.