Page Contents

Retirement is often seen as a time to relax, unwind, and enjoy the fruits of a lifetime of hard work. However, in today’s world, many older adults are reevaluating their retirement plans and considering the possibility of continuing to work beyond their traditional retirement age.

In this article, we will delve into the factors that older adults should consider when contemplating whether to work after retirement. By weighing the pros and cons, individuals can make an informed decision that aligns with their financial, physical, and emotional well-being.

Statistics, comparing work status and desire to work

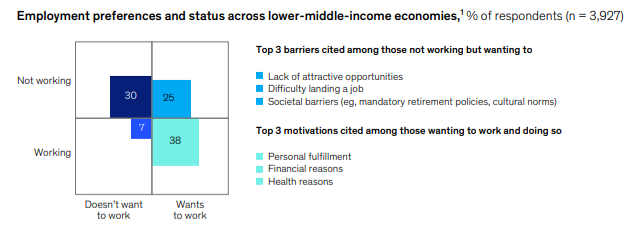

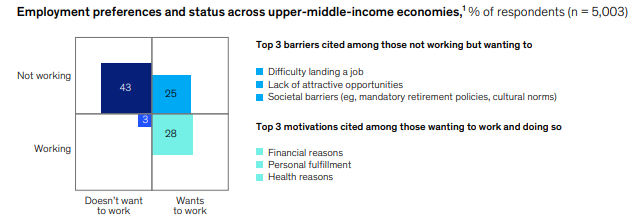

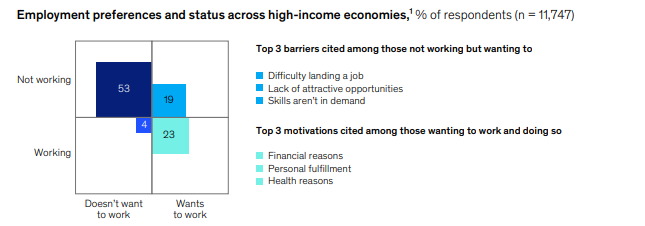

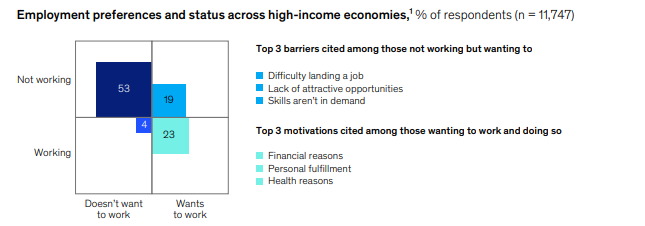

A recent global survey conducted by McKinsey Health Institute on older adults from lower-middle-income, upper-middle-income, and high-income countries shows interesting observations.

In the cohort from lower-middle-income economies (Figure 1), there are more seniors in the quardrant of Wants to work and Currently working. Their top motivation is working for personal fulfillment.

In the upper-middle-income cohort (Figure 2), there are more elderly people who are fully retired, possibly because they have enough savings and passive income to allow them to retire.

To our surprise, the main reason for the cohort who Wants to work and Currently working is for financial reasons. This is interesting where many may perceive this phenomenon should present in the lower-middle-income cohort.

Similar with second cohort in Figure 2, the high-income cohort (Figure 3) has the highest percentage of seniors who are fully retired. The other 3 quardrants appear to be lower compared to Figure 1 and 2, even though its sample size is the largest.

Financial considerations

One of the most critical factors in deciding whether to work after retirement is the financial aspect. Assessing one’s financial readiness for retirement is essential before making this decision.

- Healthcare costs

Health expenses tend to increase with age. Continuing to work could help you maintain employer-sponsored health insurance or cover medical costs before tapping on your federal or personal health insurance. - Social security benefits

Delaying the start of Social Security benefits can result in higher monthly payments. Working a few more years could increase your Social Security payments significantly, providing a more secure financial foundation.

- Retirement savings

Evaluate your retirement savings and pension plans. Determine whether your savings are sufficient to support your desired lifestyle during retirement. If you find that you might outlive your savings, continuing to work part-time or in a different capacity could be a viable option.

Health and well-being

Physical and mental health play a crucial role in determining whether older adults should continue working after retirement.

- Physical fitness

Assess your physical health and energy levels. Some individuals may be physically fit and able to handle the demands of work, while others may face health challenges that make working difficult.

- Mental sharpness

Evaluate your cognitive abilities and mental acuity. Certain jobs require continuous mental engagement, and if your cognitive function remains sharp, working after retirement may be more feasible. - Stress levels

Consider the potential stress associated with your current or prospective job. A less demanding or more flexible work arrangement may be more suitable for maintaining overall well-being.

Personal fulfillment and social interaction

Work can provide a sense of purpose, social interaction, and personal fulfillment for many older adults.

- Sense of purpose

Some individuals derive immense satisfaction and purpose from their careers. Continuing to work after retirement could contribute to a sense of fulfillment and accomplishment.

- Social connections

The workplace often serves as a hub for social interaction. If retiring means losing valuable social connections, finding part-time work or volunteering opportunities could help maintain these relationships.

Work-life balance and retirement goals

Retirement is an opportunity to pursue personal interests and spend time with loved ones.

- Work-life balance

Assess how working after retirement would impact your desired work-life balance. Part-time or flexible work arrangements can provide the best of both worlds. - Retirement goals

Clarify your retirement goals. Do you want to travel, spend more time with family, or pursue new hobbies? Ensure that continuing to work aligns with these objectives.

Conclusion

Deciding whether to work after retirement is a personal choice that depends on various factors, including financial stability, health, personal fulfillment, and retirement goals. There is no one-size-fits-all solution to this question, as individual’s unique circumstances and preferences play a significant role. Each individual must carefully weigh the pros and cons to make an informed decision.

For some, continuing to work after retirement may bring financial security and a sense of purpose, while others may choose to fully embrace their well-deserved leisure time. Employers should also treasure the life and work experiences of the senior people in order not to let it goes to waste.

Whatever your decision, you should prioritize your personal happiness, well-being, and overall quality of life.