Page Contents

In this second topic of retirement series, we will look into how to finance your retirement. This is a huge topic whereby many retirement experts have published books on generating retirement income. For this blog, we will only look at it from a broader perspective.

As mentioned in the previous blog, your retirement life follows a trajectory, this is true for your expenses as well. Once you retire, there will be changes in your lifestyle. You tend to commute less frequent; you no longer spend much on business entertainments; you may have paid off your loans; you will probably have more leisure travels, etc. When your health deteriorates at later stage, you will also spend quite a bit on healthcare and nursing care.

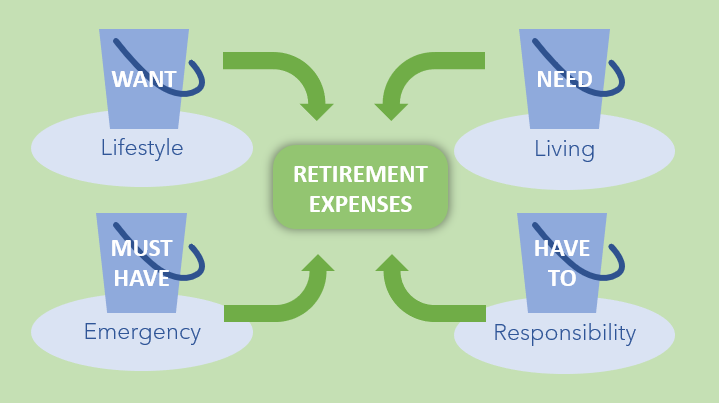

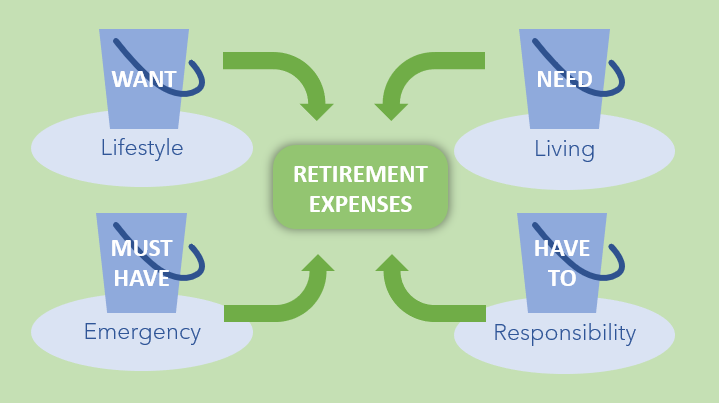

4 buckets of money for retirement

There are 4 buckets of money you need to get ready for retirement (Figure 1).- WANT – This is a lifestyle bucket. The money in this bucket is for your desired retirement lifestyle.

- NEED – This is a living bucket. You need this money for living expenses, you can rely on pension or social security.

- HAVE TO – This is a responsibility bucket. It is for paying debts, child’s education, care expenses for family and parents, etc.

- MUST HAVE – This is an emergency bucket. You must get ready an insurance for this in case for emergency or long-term care in future.

How much money you need for each bucket?

- WANT – Depends on the big-ticket item you plan to spend on, you can calculate by multiplying the frequency with an estimated amount. For example, you want to travel once a year for 10 years during retirement, you can multiply 10 years by $10,000 (estimate). That means you would need $100,000 in total.

- Need – Living expenses will gradually reduce along retirement because you would probably have less and less commitments. For instance, your current expenses are $3,000 per month. If your expenses reduced by 30%, you would need only $2,100. However, do factor in the inflation rate to get a more accurate figure. You can search for inflation rate of the country you are residing and work out the inflated cost here.

- HAVE TO – The expenses in this bucket are rather straight forward as the information is readily available if you practise regular bookkeeping. Sometimes, you may also have consolidated these expenses under living expenses.

- MUST HAVE – In previous blog on insurance, we mentioned various insurance plans that you may need. As you age, you need to make sure you have the protection for critical illnesses and disability. For a rough estimation, you would likely need to have a coverage of 15x of you yearly income.

Find your retirement income streams

Now that you know the estimated amount you need, where to find money for that? There are several sources of money you can tap into. For example:

- Pension

This is a retirement fund contributed by you and your employer during work, and paid out by employer when you retire. - Social security

This is a government-managed monetary assistance to ensure you can continue to receive money during retirement.

- Savings

Saving money while you are working will allow you to have back up resources during emergency and the flexibility for investment.

- Return from Investments

You can start investing on some endowment and annuity plans while working, this will guarantee you to have lump sum return or regular income during retirement. - Rental income

If you own an additional property (residential or commercial), you can rent it out and collect monthly rental as an income. - Side income

If you have a professional training or skillset that is on demand, you can consider converting it as a freelance or part-time services that do not require stringent time commitment yet provide extra income.

How would you like to multiply your money?

Aside from the main sources of money discussed above, there are a few other ways that you can explore to save extra money.

- Stay healthy

Staying healthy means you can reduce unnecessary medical expenses. You can achieve this by reducing your daily consumption of salt, oil, and sugar; optimise your quality of sleep, avoid sedentary lifestyle, go for yearly health checkup, etc. - Get rid of unhealthy habits

Quit smoking, drinking, and gambling. These 3 are the common bad habits that can drain away your money unknowingly and leave you with many health problems as you age. - Be vigilant and avoid scam

Scammers nowadays are everywhere; they will trick you to reveal sensitive personal information and steal your hard-earned money. Be vigilant and do not fall prey to scammer. - Choose a new housing style

There are a few options you can consider when your family size reduces during retirement, such as downsizing your house, lease buyback scheme, and co-living. These can help you save expenses and reduce maintenance. - Immigrate to another country

You can also consider immigrate to a low living-cost country for life experiences and multiply the value of your money. - Sell your unwanted goods

If you no longer need to own a vehicle for daily commuting, you can sell your car and take public transport or use ride-hailing services. You can also look for online platform or organise a garage sale to sell your unwanted items to declutter your home and make extra income.

What if you have 1 million dollars at retirement?

You may have saved a million dollars in your bank account, or inherited this amount from a rich uncle, what are you going to do with this money?

There are 2 options.

- First option, keep the money in bank, retire now and spend it according to your monthly expenses.

- Second option, withdraw 4% per year, use the remaining as a vehicle to earn dividend and grow the money.

Which one would you choose?

Let’s say you pick the first choice, assuming your monthly expenses are $3,000. If you do a quick calculation, you will find that this 1 million dollars can last approximately 27 years. If you are 40 years old now, would you want to use up all money by 67 and be poor after that? If you are 60 years old now, will you live till 87?

In this case, the $3,000 per month is still manageable. But, don’t forget you will need to factor in inflation and emergency cost. The $3,000 is just a bare minimum expenses per month, would you also want to spend a bit on travel? Simply put, this will not work.

Now left with the second choice. How would you do that in a safe manner that ensure your money can last and you have surplus for some excitements?

For the second choice, you can withdraw 4% in the first year and keep in a savings account. Meaning, $40,000 from 1 million dollars. The remaining $960,000 can be put in a rather safe investment tool such as bond to earn 3 – 5% return per annum. As such, you are basically living on investment return without depleting too much of your capital. Of course, a wise investment strategy is to invest in multiple bonds, so that you can harvest at different maturity periods and spend according to your plan. Don’t forget, on top of this, you may still have payout from your social security or pension scheme and other investments.

To find out more on 4% rule, you can check out the link here.

Conclusion

The 4% rule is just a guideline for you to withdraw 4% each year for 30 years in your retirement. If you work out the figure, you may be surprised that the amount is huge and quite challenging to achieve before retirement. The next question you may have in mind is, are you going to live for 30 years and beyond or shorter?

In the next article, we will look into what is the estimated duration you may live for your retirement. It is never a universal figure or any random number you can pluck from the air. Stay tuned!